HRRMC Tabor Tax Refund

Summary

You may have recently received a check in the mail from Heart of the Rockies Regional Medical Center with the memo line "Property Tax Refund."

In November 2022, it was brought to the attention of the Salida Hospital District (the “District”) that the District had been setting its mill levy for operating purposes in a manner that did not comply with the Taxpayer’s Bill of Rights ("TABOR").

After investigation by the District, the Board of Directors determined

to issue a voluntary TABOR refund to its property owners in the amount

of $2,305,881, which amount the Board determined to allocate in an equal

amount to each property owner who owned property in the District on January

1, 2023 as authorized by State law, Colorado case law, and TABOR.

The District sent out refund checks as described above the week beginning

March 1, 2023.

Please read below for more information on this matter. If you still have

questions after reading the information below, please call 719-530-2419.

Please do not direct questions to Chaffee, Saguache or Fremont Counties as this is a District refund matter based on TABOR overcollection, and is not related to any property taxes imposed or collected by the Counties.

FAQs

Why am I receiving this refund check?

You have been identified as a property owner within the Salida Hospital District. The Salida Hospital District receives a portion of your property taxes each year based on the mill levy it certifies in your county. A mill levy is the "tax rate" that is applied to the assessed value of a property. One mill is one dollar per $1,000 dollars of assessed value. Property taxes consist of a local portion which is used to fund area services and public schools. You can view all entities who receive a portion of your property taxes on the annual statement you receive from your assessor's office.

In November 2022, it was brought to the attention of the Salida Hospital District (the “District”) that the District had been setting its mill levy for operating purposes in a manner that did not comply with the Taxpayer’s Bill of Rights ("TABOR").

After investigation by the District, the Board of Directors determined to issue a voluntary TABOR refund to its property owners in the amount of $2,305,881, which amount the Board determined to allocate in an equal amount to each property owner who owned property in the District on January 1, 2023 as authorized by State law, Colorado case law, and TABOR.

Who is included in the Salida Hospital District?

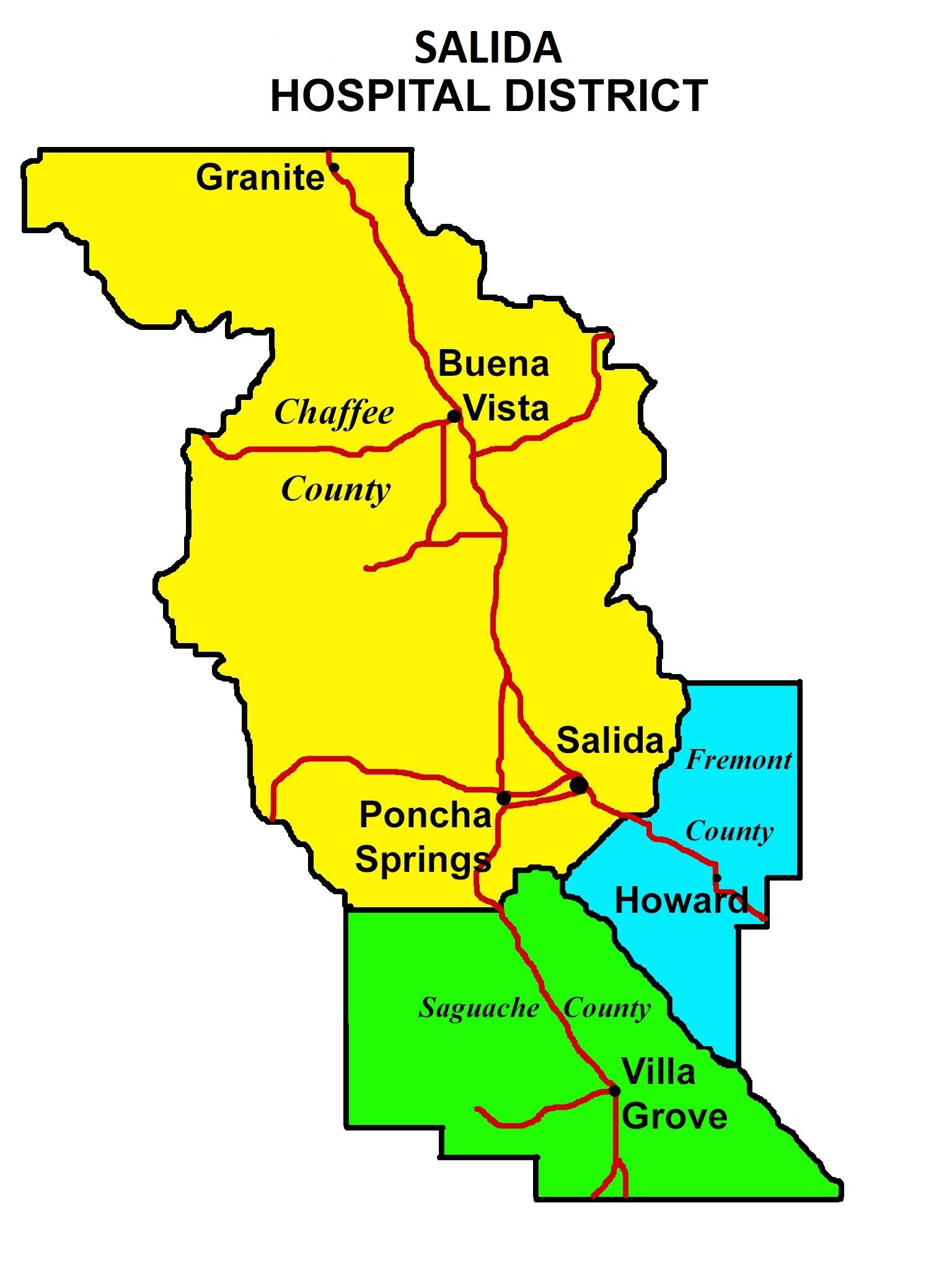

The Salida Hospital District includes all of Chaffee County, and parts of western Fremont County and northern Saguache County (please see the map below for reference).

Why did I receive multiple checks?

A separate refund will be issued for each property individually listed with your specific county.

Is this associated with a bill for being a patient or being treated at your hospital? I've never been a patient, so why am I receiving a check?

No, this is completely separate. This refund check is associated with property taxes and has nothing to do with billing for patient care.

What is the refund number listed on the check?

This number corresponds to the account number OR parcel number for each property provided by the county in which your property is located.

Why are all of the checks I received for the exact same amount of money?

The total refund amount due as a whole was divided equally amongst all properties that are part of the Salida Hospital District. The amount was not prorated based on the actual tax you may have paid.

Will I be receiving further refunds from HRRMC?

No, this is a one-time refund.

Additional Communication about the refund

Please read the press release HRRMC sent to the public and local media on Dec. 20, 2022.

Please read the Salida Hospital District Resolution 2023-1 about this matter.

If you still have questions after reading this information , please call 719-530-2419.